Unlocking Your Competitive Advantage: A Guide to Corporate Strategy

Having a good corporate strategy is crucial for the success of any business, regardless of their size and experience. Oftentimes this important, overarching strategic vision gets lost in the many diverse but interconnected parts of running a company, but being able to align your people and resources to a central strategy can make all the difference for your team and your customers.

What is corporate strategy?

Harvard Business School professors Cynthia Montgomery and David Collis define it as “the way a company creates value through the configuration and coordination of its multimarket activities.” Corporate strategy involves profitability decisions that affect every market the firm operates in (or plans to operate in eventually). This is distinct from a firm’s business strategy, which focuses on how a firm will compete and differentiate itself in a single market. Creating a corporate strategy, even if you do not operate in multiple markets currently, will give you direction on what kind of activities to pursue and prioritise, and which are outside of your scope.

Boston Consulting Group defines corporate strategy as the way to ensure the entire business is worth more than the sum of its parts. Each part of the business should have its own goals that fit within the overall framework for the firm’s corporate strategy, to ensure cohesion and alignment. To adequately create your corporate strategy and assign business units sub-strategies, you will need to understand your competitive advantage. Your competitive advantage should inform your corporate strategy and all your business decisions, as it is how your business outperforms competitors in a market. Your competitive advantage will often come from the strategic resources you have and deploy better than others.

How do you determine your competitive advantage?

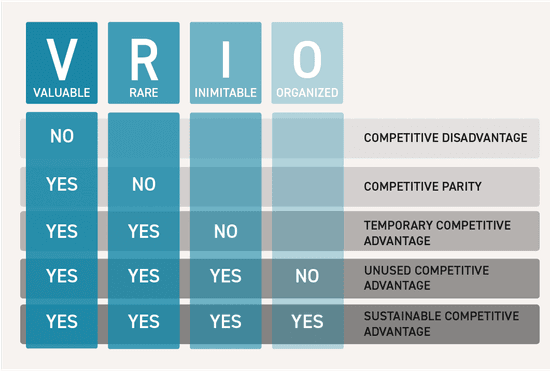

One popular method you can leverage to understand your unique competitive advantage is the VRIO framework that analyses your resources and capabilities. VRIO stands for Valuable, Rare, Inimitable, and Organised. Let’s go through each one:

Valuable:

Do your resources provide a value proposition, such as lower costs or superior products?

Rare:

Are your resources hard to attain or possess by competitors?

Inimitable:

Can competitors easily replicate your resources, or is it difficult or costly to do so?

Organised:

Does your firm have the organisational capabilities (the structure, systems, and culture) to effectively utilise your resources to gain a sustained competitive advantage in the long term?

By systematically evaluating resources through this VRIO lens, a firm can pinpoint the unique strengths that contribute to its long-term competitive advantage. Your resources (another word for assets) could be tangible or intangible. Examples of tangible resources include buildings, human capital, real estate, hardware, equipment, and vehicles. Intangible resources are things like software, databases, company reputation, tacit knowledge and “know-how”, brand, customer/user base, industry relationships, patents, algorithms, content, and internal processes and systems.

Another way to think about your competitive advantage is through the lens of first mover advantage, which occurs when a company is the first to bring a new product or service to the market. As a result of first mover advantage, companies can enjoy the following other advantages:

Economies of Scale:

Being first (or early) to a high growth market means you have a head start on production, and as you leverage your fixed costs of production over more units produced, you can reach economies of scale and your fixed costs will decrease per unit. This creates a barrier to entry for newcomers, since it will take a while to attain competitive parity on price per unit. The incumbent’s large customer base is the resource that is generating this competitive advantage. Examples of economies of scale are often found in manufacturing and factories where the fixed costs of machinery can be leveraged again and again for more units produced.

Network Effects:

This occurs when the value of the service to a consumer increases with the number of consumers using the product. Good examples of this are the internet, social media platforms, and online marketplaces. Only as more people use the product does it gain value. First movers will have an advantage as they have attained a large customer base and potentially instituted switching costs, deterring customers to go to competitor products.

Learning Economies:

When your product increases in value with the number of past users, you have leveraged learning economies, which is the tacit knowledge gained through experience. By producing more, the organisation learns how to do things better, more efficiently, and more cost effective. Examples of this include surgical teams that get better at performing operations together as time goes on, or Netflix’s algorithm that recommends what to watch next by learning what individuals like over time.

Examples of competitive advantage

It can be hard to pinpoint exactly what gives certain companies a competitive advantage as an outsider, but there are some things that are more obvious and can be determined by analysing the firm’s resources through the VRIO framework. For example:

Apple has a competitive advantage by being a first mover in the smart phone space and creating high switching costs for users by creating the IOS ecosystem around its products.

Ikea has a competitive advantage in its low-cost production by leveraging its manufacturing machinery over many units produced and using low-cost materials.

Kinabase has a competitive advantage in its unique, proprietary software platform that uses AI to create customisable business management solutions and house customer data, enabling customers to build bespoke systems in minutes, not months or years.

Disney has a competitive advantage in using its animated characters across multiple markets (movies, theme parks, and stuffed toys) to create synergies and increase revenue.

Synergies

I would be remiss to speak about corporate strategy without mentioning synergies. A synergy occurs when the value of operating two businesses together is higher than the value of operating them separately. There must be a key resource that can be leveraged across the two businesses/activities/products, such as a shared animated character like Mickey Mouse, from the Disney example above. Other examples could include sharing industry data to create a new, better product together, sharing tacit knowledge from learning economies to create better efficiency, or leveraging the same back-office functions across multiple businesses in the same category.

Exploiting synergies leads to economies of scope, which is like economies of scale but occurs when a shared resource, rather than a fixed cost, is leveraged across multiple businesses or divisions, lowering the average cost of production. Furthermore, exploiting synergies makes your business harder for competitors to copy due to the complexity and interconnectedness of the resources used, adding to your competitive advantage.

By identifying your firm’s unique competitive advantage(s), you will be able to more accurately create a corporate strategy that reflects your core competencies and the direction you want your firm to grow, whether that be through acquisitions, breaking into new markets, or becoming the market leader in a single market. There are endless possibilities for growth, and the global market is always evolving and shifting as technology changes and customer preferences update. One thing is for sure, a bias to action gives you more opportunity to create meaningful value.

After you’ve laid this groundwork around competitive advantage and strategic scope, you can better coordinate and align your departments/employees to push toward your firm’s goals together, whether that be through culture-building all-hands meetings, pay-for-performance incentive schemes, or collaboration platforms that ensure your teams are aligned and communicating. Kinabase can help you strengthen your competitive advantage and make it sustainable. As a business management platform, Kinabase can create flexible workflows, use AI to build custom data collections, integrate with other technologies such as Microsoft 365 and SharePoint for team collaboration, and create value through organising your internal processes and systems.

Conclusion

Having explored the strategic concepts above, the next step is to convene your team and collaboratively construct your firm's unique resource profile. By evaluating your resources through the lens of the VRIO framework and first mover advantage, you can uncover your inherent competitive advantage. As your corporate strategy evolves over time, informed by your competitive advantage and strategically valuable resources, the path to sustainable success will become increasingly clear.

Sources

- Barney, J. (1991). ‘Firm Resources and Sustained Competitive Advantage.’ Journal of Management, 17(99-120).

- Collis, D., and Montgomery, C. (2005). Corporate Strategy: A Resource-Based Approach. 2nd ed. Boston: McGraw-Hill/Irwin.

- “Corporate Strategy.” (2024). Boston Consulting Group. https://www.bcg.com/capabilities/corporate-finance-strategy/corporate-strategy

- Wernerfelt, B. (1984). ‘A Resource Based View of the Firm.’ Strategic Management Journal, 5(171-180).

Recent Articles

Sleigh Bells and Stock Levels: How a Single Source of Truth Streamlines

Turn seasonal pressure into a plan for durable, data-led advantage for a smoother transition into a smarter Q1.

Data Without the Headache: AI-Powered Insights for Decision-Makers

How AI Reduces Complexity and Enables Smarter, Faster Decisions .

Customising Your Digital System for Long-Term Growth

Utilising the flexibility of Kinabase to track and evolve with business needs.